Salesforce Maps

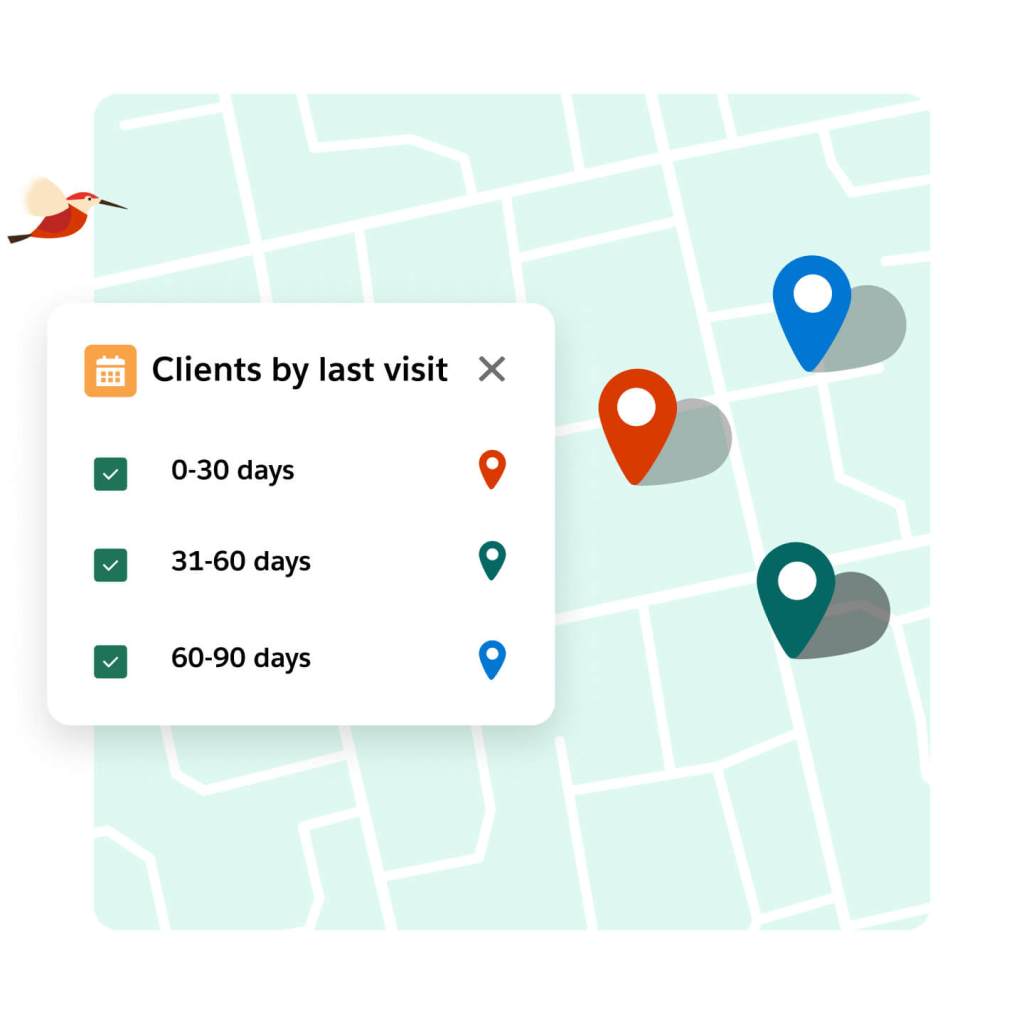

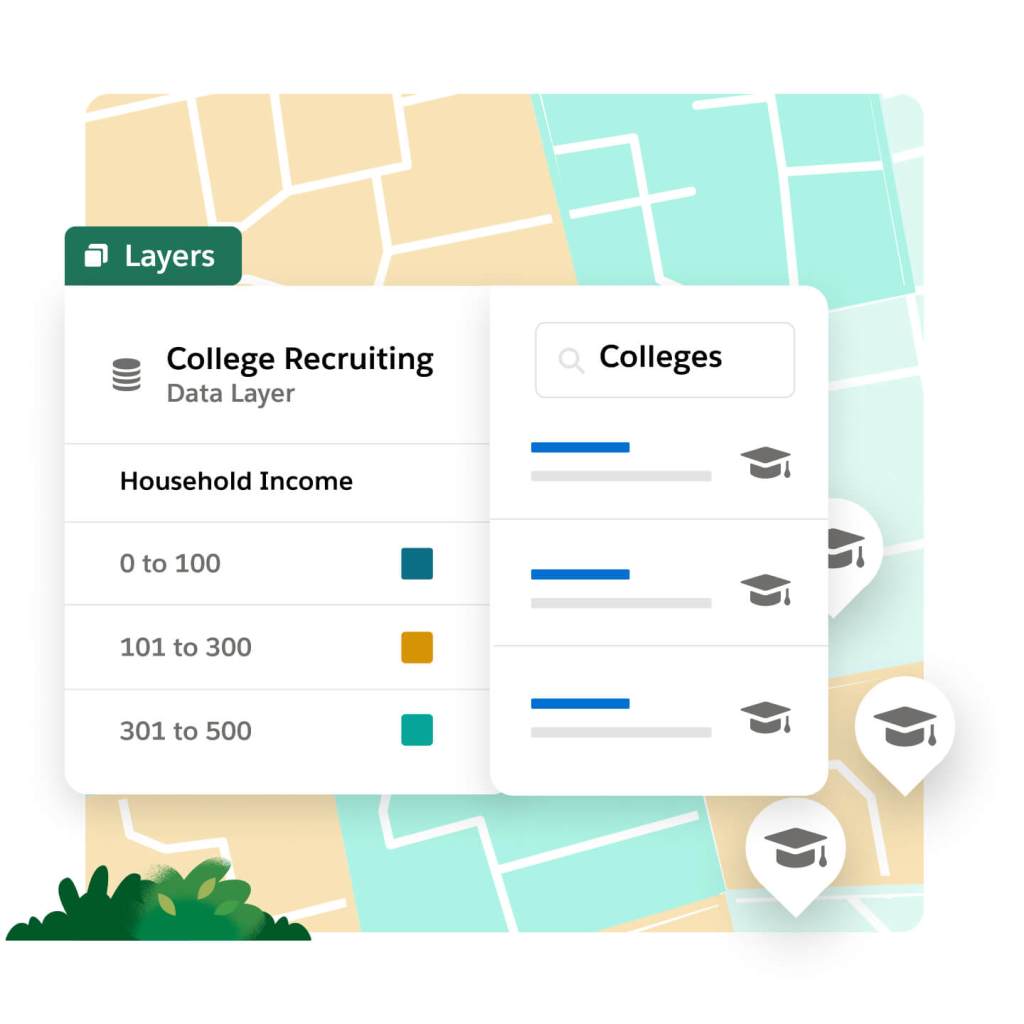

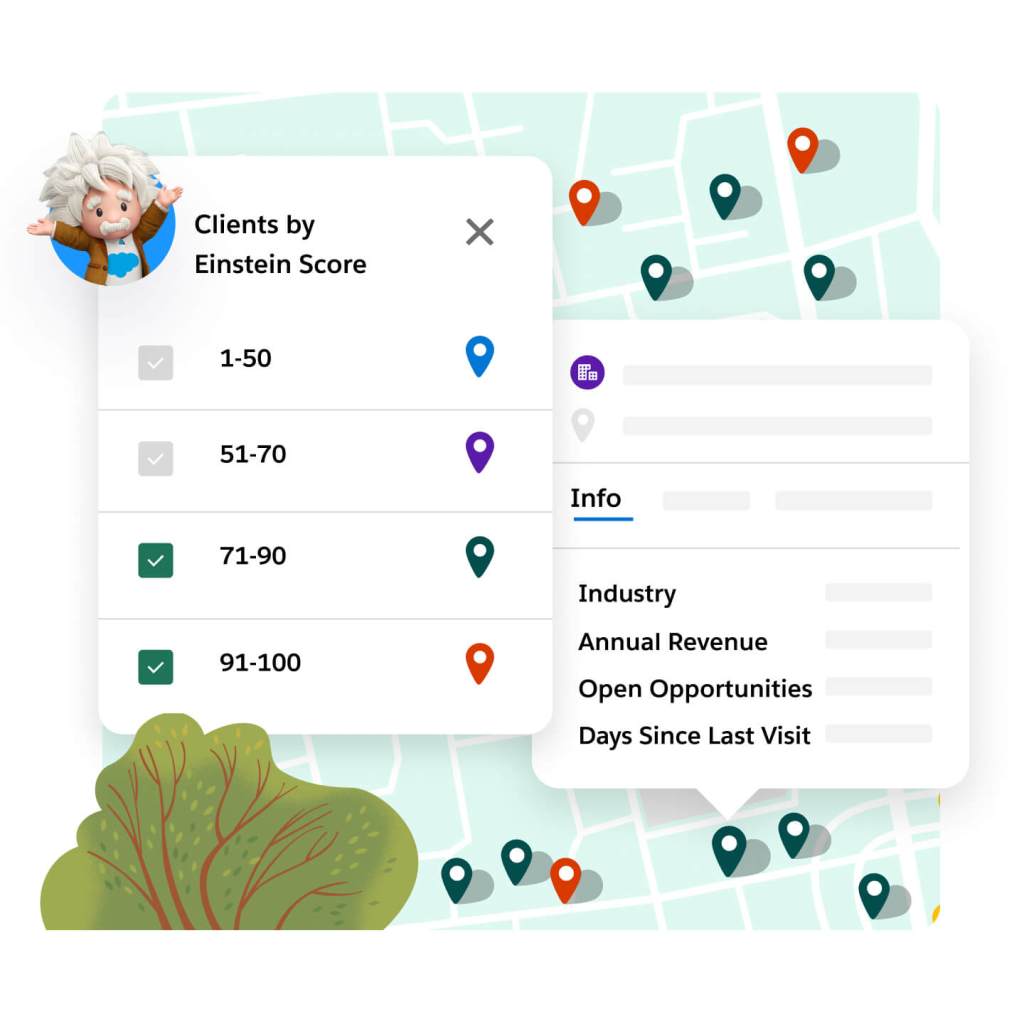

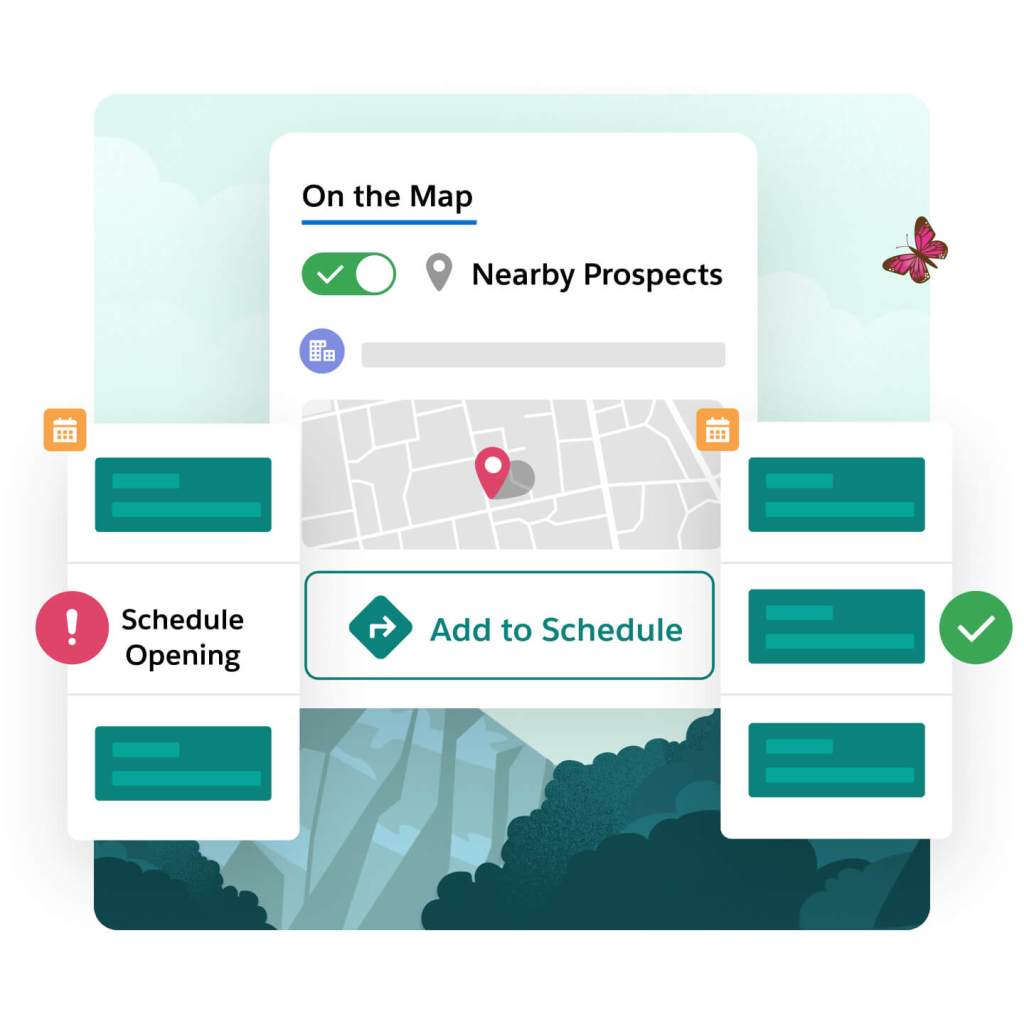

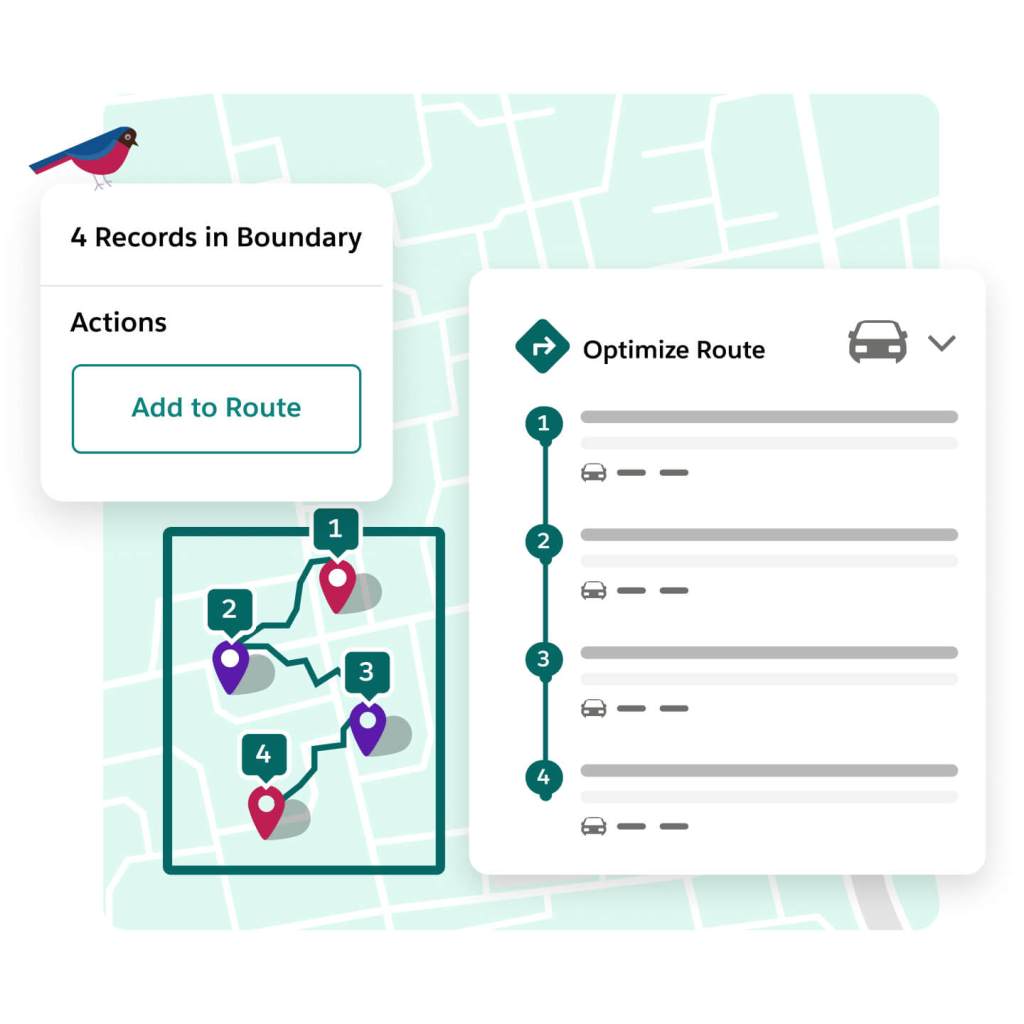

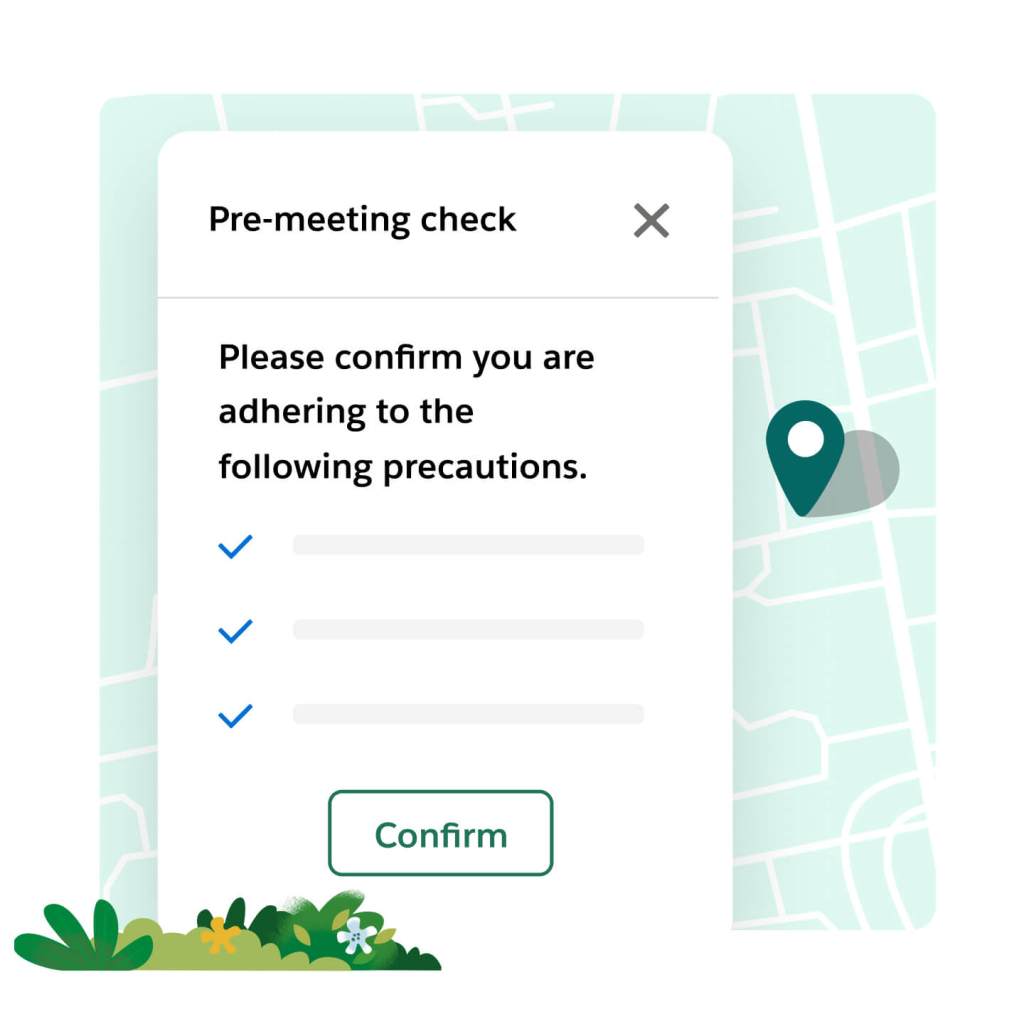

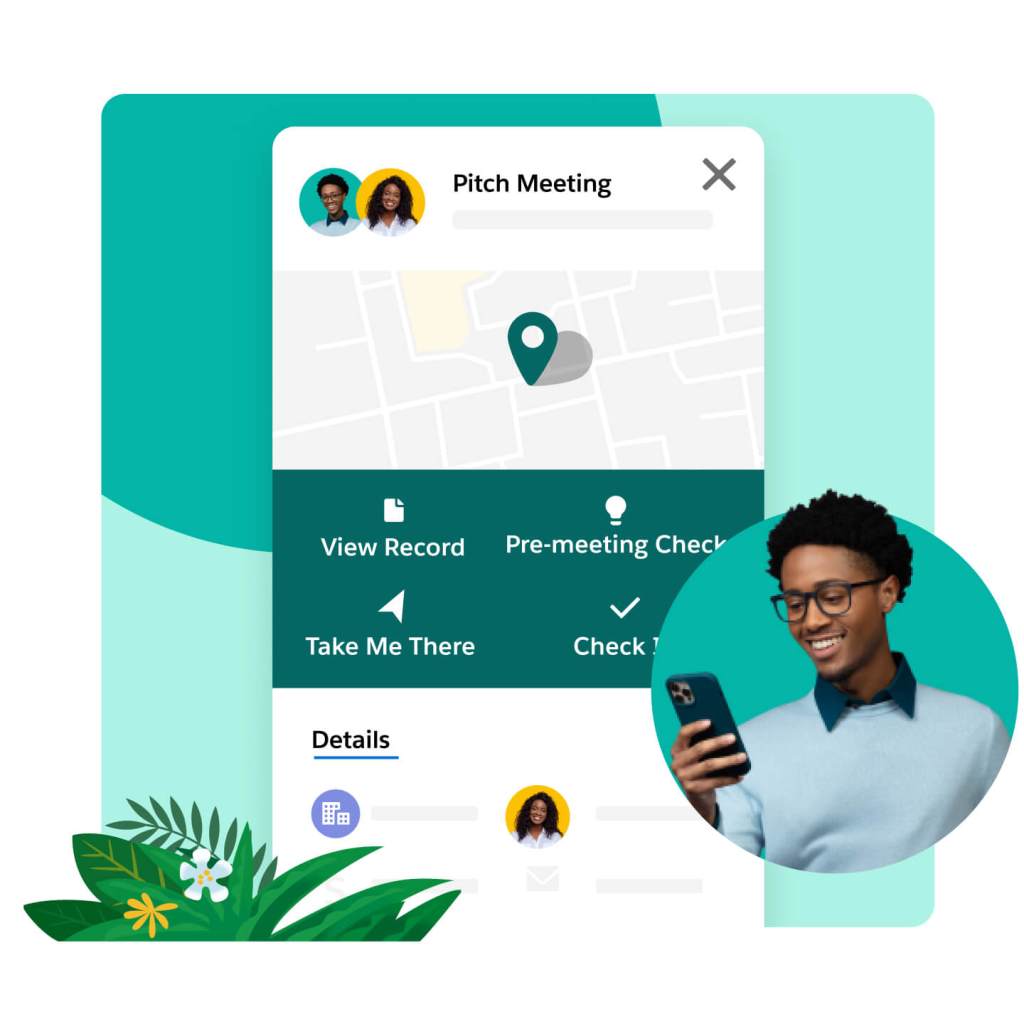

Sell efficiently with CRM-based sales mapping software. Make smarter prospecting decisions with customer record visualization. Streamline account planning while in the field, optimize field routes, and save time by automating record-keeping tasks.